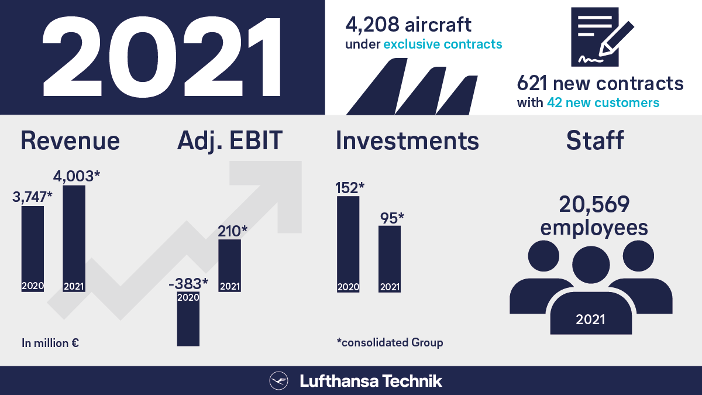

Lufthansa Technik returned to profitability during the 2021 financial year. It credited the success to restructuring, a clear customer focus and the further development of its product portfolio. The company increased revenue by 7% to €4.003bn (from €3.747bn the previous year) and again generated a clearly positive adjusted EBIT of €210m (from -€383m the previous year).

“2021 was another tough year that demanded everything from all of us,” said Dr Johannes Bussmann, chairman of the executive board of Lufthansa Technik. “We have rigorously reorganised and restructured painfully, but today Lufthansa Technik is better, more efficient and more powerful than before the crisis. We owe this not least to the commitment and flexibility of our employees.”

The turnaround was centrally managed by the RISE programme, which was launched as early as 2020. Its measures included a more streamlined organisation with only five segments instead of eight business units, as well as structural changes that included the closure or sale of maintenance and overhaul sites. There were no compulsory redundancies in Germany.

“The necessary measures, some of which were really tough, have deeply affected the core of Lufthansa Technik’s identity,” said Bussmann. “Nevertheless, I am relieved that we were able to spare our workforce the worst effects.”

Noticeable upturn in air traffic

The 2021 result was still extensively supported by government aid such as the short-time working allowance in Germany. Another important driver of the positive development was a noticeable upturn in the maintenance business due to the recovery of global air traffic. The Aircraft Component Services business segment in particular, which is heavily dependent on the number of hours flown, felt the effects of this through significantly better capacity utilisation in its workshops. In contrast, Lufthansa Technik said there was only a slight recovery in the engine business, with airlines still often taking advantage of the remaining ‘green time’ service life of parked engines in 2021 to avoid overhauls.

However, Lufthansa Technik said that order intake clearly shows that the industry is committed to working with the company, especially in difficult times. Over the course of 2021, the sales organisation won 42 new customers and signed more than 620 contracts with a total volume of €4.7bn. Among the new customers were various start-up airlines, which Lufthansa Technik supports with expertise in setting up their technical operations. At the end of the 2021 fiscal year, the company had exclusive contracts governing more than 4,200 aircraft owned by more than 800 customers. Lufthansa Technik said that by focusing closely on the needs of its customers, it was able to nearly maintain its customer base throughout the crisis period.

Bussmann sees this as confirmation of his strategy: “The fact that we still service the largest share of the world’s commercial aircraft fleet is no coincidence. In terms of sales, it is now paying off that before the crisis, we systematically invested in capabilities for the major new aircraft and engine types and in state-of-the-art technologies. This puts us in the unique position today of being able to support any customer’s aircraft fleet immediately – without any investment backlog.”

At least 1,500 new hires planned worldwide

Lufthansa Technik is aiming to increase its workforce worldwide by more than 1,500 this year, bringing it back up to about 22,000 employees. Of these, approximately 700 full-time positions will be in Germany, approximately 600 in the Americas region and approximately 200 in the Asia-Pacific region. The company is primarily looking for skilled workers in the areas of components, engines and logistics, as well as experts in administrative areas such as sales and IT.

A corresponding recruitment campaign will start this month. Lufthansa Technik said that in addition to what it called its classic strengths, including internationality and diversity and a broad range of entry-level opportunities for a wide variety of target groups, it wants to focus on actively shaping the future of aviation, playing a major role with modern digital technologies as well as innovative and sustainable products.

Increasing digitalisation

The topics of digitalisation and sustainability already played a major role at Lufthansa Technik last fiscal year. The expansion of digital customer services continued to focus on the company’s in-house development, the Aviatar platform, which recorded strong growth and popularity in 2021 and will celebrate its fifth anniversary this year. Airlines such as United Airlines, Sichuan Airlines, Etihad Airways and TAP Air Portugal were acquired as new customers for various digital Aviatar services in 2021. In total, more than 3,000 aircraft are now supported on the platform. “Aviatar has finally established itself on the market as the only manufacturer-independent digital solution,” said Bussmann. “And demand has once again increased significantly, especially during and after the crisis.”

Digitalisation also continued to pick up speed in fiscal year 2021 apart from the Aviatar platform. The Virtual Table Inspection (VTI) for the online inspection of engine parts, which is operated via a dedicated 5G campus network, was transferred to everyday regular operation in 2021. In addition, the combination of drones and AI for the visual inspection of commercial aircraft was presented at the ITS World Congress in Hamburg, Germany.

Sustainability

The company said a lighthouse project in the field of sustainability is the nature-inspired, drag-reducing AeroShark riblet film. In May 2021, Lufthansa Cargo became the first customer for this technology, which was developed jointly with BASF. Starting this year, Lufthansa Cargo’s entire fleet of Boeing 777 freighters will be equipped with it. Swiss recently also decided to use AeroShark on its Boeing 777 fleet.

“With products like AeroShark, we are also the only independent MRO service provider that offers its customers self-developed sustainability solutions to achieve their climate goals,” said Bussmann. “On the way to making air transport climate-friendly, Lufthansa Technik is clearly part of the solution, not the problem.”

Another project targeting more sustainable aviation is a project initiated last July to study MRO and ground processes for future hydrogen-powered aircraft. Starting next month, the Hydrogen Aviation Lab in the form of an A320 will be used to also gain practical knowledge from the user’s perspective, which can then be incorporated at an early stage in the development of the first production-ready hydrogen commercial aircraft for the target period of 2035.

Return to pre-crisis levels still expected by 2023

Lufthansa Technik said that the timeframe in which aviation, and with it the MRO industry, will fully return to its former economic strength, remained difficult to predict, due to the current geopolitical situation, the still unclear prospects for opening up many regions of the world, and the rising prices of raw materials, fuel and spare parts. However, the company said the global MRO market has performed US$6bn better last year than was forecast at the beginning of 2021. In total, its volume is currently estimated to be US$79bn, distributed relatively evenly among the three regions Americas, Europe-Middle East-Africa (EMEA) and Asia-Pacific (APAC). Due to “the ongoing recovery”, Lufthansa Technik is standing by its earlier estimate that the overall global MRO market will return to pre-crisis levels by 2023.

However, it said the medium- and long-term consequences of the war in Ukraine were unclear. Bussmann said the war had “shown us how fragile peace in the world is, and how quickly an order that was thought to be secure can fundamentally change. We very much hope that the war and the suffering of the people there will come to a swift end.”

Lufthansa Technik has also begun preparations for possible changes in its ownership structure. By the end of 2023, the Lufthansa Group is still aiming either to sell a minority stake to an investor or to initiate a partial IPO.

All figures in this story refer to Lufthansa Technik and its fully consolidated companies, including Lufthansa Industry Solutions.